Examining the Impact of Market Reaction Pattern, Managerial Ability, and Corporate Governance on Tax Avoidance in Companies Listed on the Tehran Stock Exchange

Keywords:

market reaction, managerial ability, corporate governance, tax avoidance, Tehran Stock ExchangeAbstract

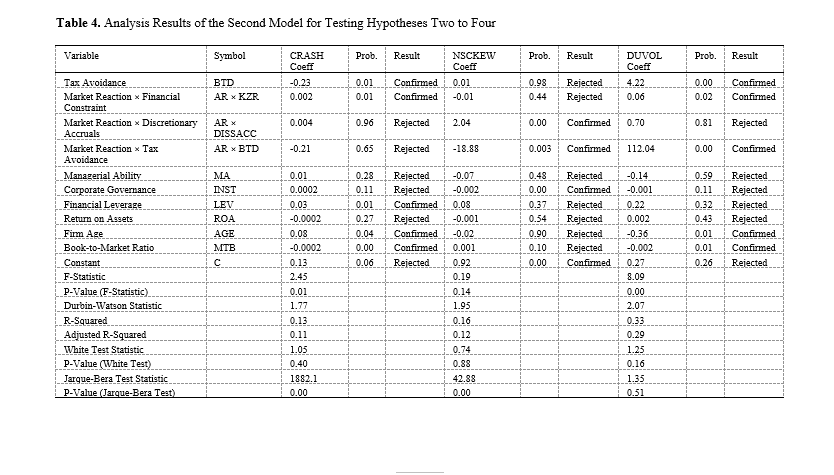

The primary objective of this study is to examine the impact of the market reaction pattern, managerial ability, and corporate governance on tax avoidance in companies listed on the Tehran Stock Exchange. This research is applied in nature and employs a quasi-experimental, post-event approach within the field of positive accounting research. It utilizes multivariate linear regression and econometric models for analysis. To test the hypotheses, the significance of each regression coefficient was examined using the t-test. The final data analysis was conducted using Excel (2019) and Eviews (10) software. The findings from the hypotheses indicated that tax avoidance has a significant impact on the risk of future stock price crashes. Furthermore, market reaction moderates the impact of tax avoidance, discretionary accruals, and financial constraints on the risk of future stock price crashes. Additionally, managerial ability moderates the impact of financial constraints on the risk of future stock price crashes. Corporate governance moderates the impact of tax avoidance and discretionary accruals on the risk of future stock price crashes. The results showed that managerial ability does not moderate the impact of tax avoidance, discretionary accruals, or financial constraints on the risk of future stock price crashes.

References

A. Yamen, "Impact of Institutional Environment Quality on Tax Evasion: A Comparative Investigation of Old Versus New EU Members," Journal of International Accounting, Auditing and Taxation, vol. 32, pp. 17-29, 2018, doi: 10.1016/j.intaccaudtax.2018.07.001.

L. B. Abdixhiku, G. Krasniqi, I. Pugh, and I. Hashi, "Firm-level Determinants of Tax Evasion in Transition Economies," Economic Systems, vol. 41, no. 3, pp. 354-366, 2017, doi: 10.1016/j.ecosys.2016.12.004.

S. Khalil and Y. Sidani, "The Influence of Religiosity on Tax Evasion Attitudes in Lebanon," Journal of International Accounting, Auditing and Taxation, vol. 40, pp. 220-235, 2020, doi: 10.1016/j.intaccaudtax.2020.100335.

S. Agarwal, K. Li, Q. Yu, W. Jing, and J. Yan, "Tax Evasion, Capital Gains Taxes, and the Housing Market," Journal of Public Economics, vol. 188, pp. 104-122, 2020, doi: 10.1016/j.jpubeco.2020.104222.

M. Ghasemi, S. Abedi, and Mohtashami, "Providing a Tax Evasion Prediction Model for Businesses Based on Data Mining Techniques," Tax Research Journal, vol. 30, no. 56, pp. 7-30, 2022, doi: 10.52547/taxjournal.30.56.1.

A. Esmaeilzadeh, M. Eskafi Asl, and F. Nazemi, "Examining the Effect of Corporate Governance and Reputation Risk on the Relationship Between Tax Minimization and Stock Price Reaction," Financial Economics (Financial Economics and Development), vol. 12, no. 42, pp. 229-265, 2018. [Online]. Available: https://www.sid.ir/paper/511359/fa.

M. Eslami and A. H. Erzaei, "The Relationship Between Real Earnings Management, Corporate Governance, and Stock Price Crash Risk (Dynamic Panel Data Approach)," Journal of Fiscal and Economic Policies, vol. 11, no. 43, pp. 65-97, 2023, doi: 10.61186/qjfep.11.43.65.

A. Momeni Yansari, "Financial Status and Future Stock Price Crash Risk: The Importance of Internal Control Quality in Companies," Journal of Financial Accounting and Auditing Research, vol. 15, no. 60, pp. 157-174, 2023. [Online]. Available: https://journals.iau.ir/article_707971.html?lang=en.

Y. Si and C. Xia, "The Effect of Human Capital on Stock Price Crash Risk," Journal of Business Ethics, vol. 187, no. 3, pp. 589-609, 2023, doi: 10.1007/s10551-022-05134-w.

H. A. R. Irigaray, "Reflections on Business Resilience, Corporate Governance, and Corporate Social Responsibility," Cadernos Ebape Br, vol. 22, no. 1, 2024, doi: 10.1590/1679-395190025x.

B. Mahmudi, "Corporate Governance Mechanisms and Financial Performance: A Systematic Literature Review in Emerging Markets," Productivity, vol. 1, no. 3, pp. 270-285, 2024, doi: 10.62207/gqtv4c76.

L. T. Thoan, "Corporate Governance in Listed Firms: Does Market Competition Make a Difference?," Asian Academy of Management Journal, vol. 29, no. 1, pp. 171-203, 2024, doi: 10.21315/aamj2024.29.1.7.

B. E. Hermalin and M. S. Weisbach, "Assessing Managerial Ability: Implication for Corporate Governance," in Handbook of the Economics of Corporate Governance, 2017.

Y. Badaavar Nahandi and N. Heshmat, "The Effect of Corporate Governance Mechanisms on the Relationship Between Managers' Ability and Value Creation for Shareholders," Management Accounting, vol. 11, no. 38, pp. 93-108, 2018. [Online]. Available: https://www.sid.ir/paper/198675/%d8%ae%d8%b1%db%8c%d8%af%20%d8%a7%d9%82%d8%b3%d8%a7%d8%b7%db%8c%20%da%af%d9%88%d8%b4%db%8c%20%d8%a2%db%8c%d9%81%d9%88%d9%86%2014/fa.

M. Fakhri, A. Pazaki, and F. Khoshkar, "Examining the Impact of Management Ability on the Relationship Between Corporate Governance and Tax Avoidance," Journal of New Research Approaches in Management and Accounting, vol. 3, no. 11, pp. 22-41, 2019. [Online]. Available: https://majournal.ir/index.php/ma/article/view/284.

J. Park, Y. C. Ko, H. Jung, and Y.-S. Lee, "Managerial Ability and Tax Avoidance: Evidence from Korea," Asia-Pacific Journal of Accounting & Economics, vol. 23, no. 4, pp. 449-477, 2016, doi: 10.1080/16081625.2015.1017590.

M. Hassani Ghar and S. Shaeri Anaghiz, "Examining the Impact of Management Ability on Tax Avoidance," Accounting Knowledge, vol. 8, no. 1, pp. 107-134, 2017. [Online]. Available: http://ensani.ir/fa/article/373454/%D8%A8%D8%B1%D8%B1%D8%B3%DB%8C-%D8%AA%D8%A3%D8%AB%DB%8C%D8%B1-%D8%AA%D9%88%D8%A7%D9%86%D8%A7%DB%8C%DB%8C-%D9%85%D8%AF%DB%8C%D8%B1%DB%8C%D8%AA-%D8%A8%D8%B1-%D8%A7%D8%AC%D8%AA%D9%86%D8%A7%D8%A8-%D9%85%D8%A7%D9%84%DB%8C%D8%A7%D8%AA%DB%8C.

D. Di Gioacchino and D. Fichera, "Tax Evasion and Tax Morale: A Social Network Analysis," European Journal of Political Economy, vol. 65, pp. 121-149, 2020, doi: 10.1016/j.ejpoleco.2020.101922.

S. Karimi Patanlar, M. T. Gilak Hakimabadi, and N. F. Saber, "Examining the Effect of Government Effectiveness on Reducing Tax Evasion in Selected Countries," Tax Research Journal, vol. 23, no. 27, pp. 63-90, 2016. [Online]. Available: http://taxjournal.ir/article-1-709-en.html.

E. Mohammadi and H. Asna-Ashari, "The Relationship Between Earnings Management Patterns and Stock Price Crash Risk, Emphasizing the Role of Audit Quality," Journal of Empirical Studies in Financial Accounting, vol. 18, no. 71, pp. 171-200, 2021. [Online]. Available: https://qjma.atu.ac.ir/article_12773.html?lang=en.

S. Mahdipour Ahangar, "Examining the Moderating Effect of Market Reaction on the Relationship Between Social Responsibility and Conservatism," 2021.

S. M. B. Hosseini, "The Impact of Managerial Ability on the Relationship Between Financial Reporting Quality, Investment Efficiency, and Future Stock Price Crash Risk," 2021.

W. H. Yeung and C. Lento, "Ownership Structure, Audit Quality, Board Structure, and Stock Price Crash Risk: Evidence from China," Global Finance Journal, vol. 37, pp. 1-24, 2018, doi: 10.1016/j.gfj.2018.04.002.

Z. Amanollahi and N. Ahadnejad, "Examining the Impact of CEO Personality Power on Stock Price Crash Risk in Listed Companies," Journal of New Research Approaches in Management and Accounting, vol. 7, no. 26, pp. 500-515, 2023. [Online]. Available: https://majournal.ir/index.php/ma/article/view/2239.

M. Al Mamun, B. Balachandran, and H. N. Duong, "Powerful CEOs and Stock Price Crash Risk," Journal of Corporate Finance, vol. 62, p. 101582, 2020, doi: 10.1016/j.jcorpfin.2020.101582.

A. Dumitrescu and M. Zakriya, "Stakeholders and the Stock Price Crash Risk: What Matters in Corporate Social Performance?," Journal of Corporate Finance, vol. 67, p. 101871, 2021, doi: 10.1016/j.jcorpfin.2020.101871.

K. Jebran, S. Chen, and R. Zhang, "Board Social Capital and Stock Price Crash Risk," Review of Quantitative Finance and Accounting, vol. 58, no. 2, pp. 499-540, 2022, doi: 10.1007/s11156-021-01001-3.