Examining the Impact of Deviation from Target Leverage on the Probability of Corporate Bankruptcy

Keywords:

target leverage, logit, Bankruptcy riskAbstract

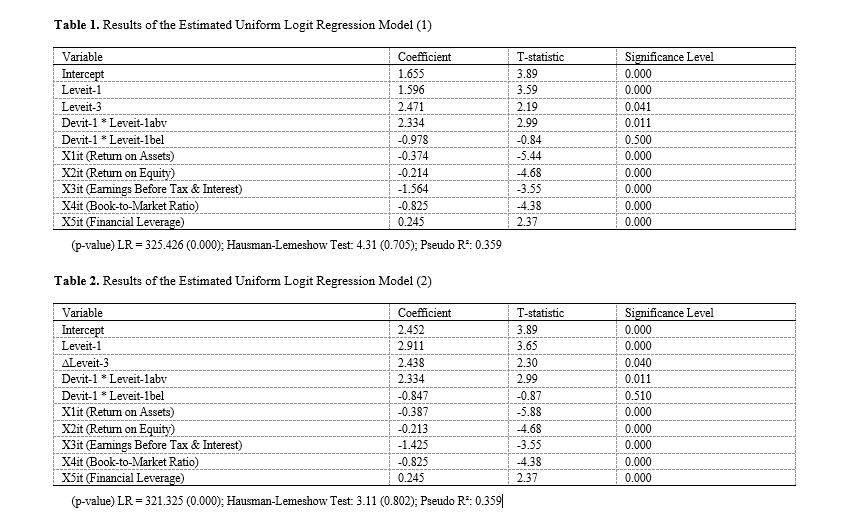

Deviation of companies’ leverage from optimal leverage can result in the imposition of costs and an increased risk of bankruptcy. In this study, we examine the effect of companies’ deviation from optimal leverage on the probability of bankruptcy. For this purpose, data from 86 companies over a 6-year period were collected. The analysis and hypothesis testing were conducted using the statistical software EViews and logistic regression methodology. The results showed that deviation from target leverage for companies with leverage higher than the target leverage had a significant relationship with the risk of bankruptcy. In other words, the more a company's leverage exceeds its target leverage, the higher the probability of bankruptcy. However, for companies with leverage lower than the target leverage, no significant relationship was found with the probability of bankruptcy. On the other hand, leverage with a one-year and three-year lag had a significantly positive relationship with the probability of bankruptcy.