Application of Meta-Synthesis Technique in Bank Profitability Model Considering the Role of Modern Banking Technologies

Keywords:

Profit Optimization, Bank Profitability, Modern Banking TechnologiesAbstract

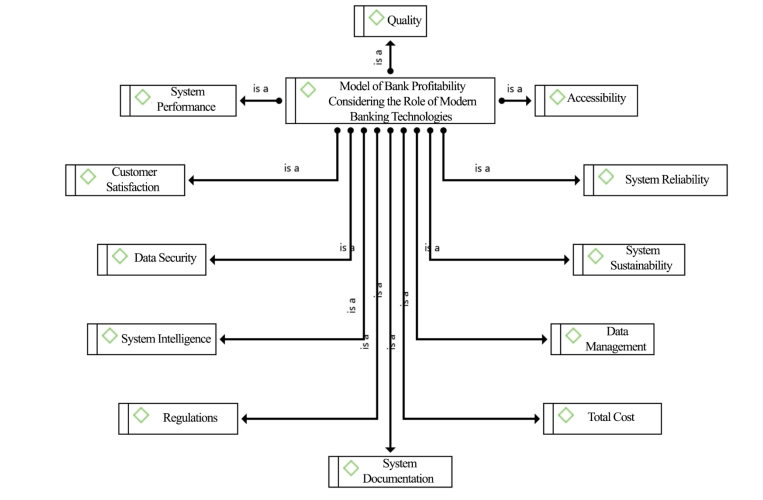

The profitability of banks, as one of the key performance indicators, depends on their ability to generate income and manage costs. In recent decades, the emergence of modern banking technologies has led to significant transformations in the banking industry, which have had a direct impact on the profitability of banks. The purpose of this study is to apply the meta-synthesis technique to the bank profitability model, considering the role of modern banking technologies. The researcher employed a systematic review and meta-synthesis approach to analyze the results and findings of previous researchers. By following the seven steps of the Sandelowski and Barroso method, the researcher identified the influential factors. Out of 277 articles, 25 articles were selected based on the CASP method, and the validity of the analysis was confirmed with a Kappa coefficient of 0.760. In this context, to assess reliability and quality control, the transcription method was used, and the level of agreement for the identified indicators was found to be excellent. The analysis of the collected data using ATLAS.ti software led to the identification of 52 initial codes in 12 categories. Based on the meta-synthesis technique, the 12 categories were classified according to these concepts. The 12 categories are: system sustainability, cost-effectiveness, system performance, data security, accessibility, regulations, system intelligence, customer satisfaction, system reliability, system documentation, data management, and quality. System sustainability in the bank profitability model, considering the role of modern banking technologies, refers to the bank's ability to maintain and enhance its financial performance in the long term. Modern technologies such as artificial intelligence, blockchain, and advanced security systems help banks effectively manage risks and prevent cyber threats and financial fraud. These technologies increase customer confidence and trust in the banking system and ensure sustainable profitability for banks by reducing costs associated with risks and potential losses.