Applying the Exploratory Factor Analysis Approach in Ranking Key Indicators of Tax Avoidance in Industries

Keywords:

Corporate Income Tax, Tax Avoidance, Effective Tax RateAbstract

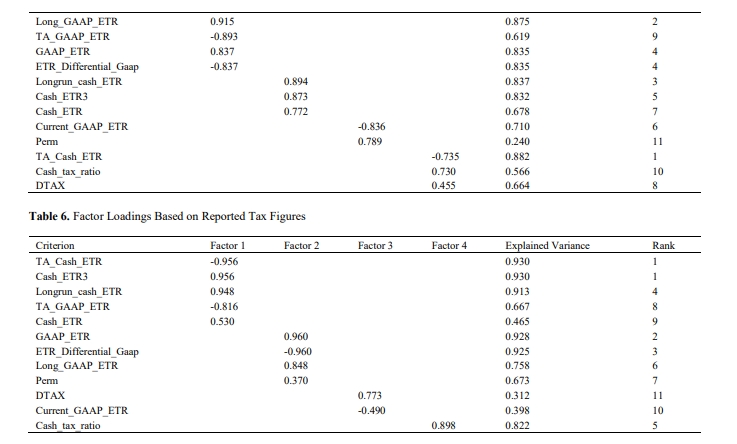

One of the key topics in accounting is the investigation of factors influencing tax avoidance and its metrics, which are closely related to the concept of evaluating corporate tax planning. The statistical data for calculating 12 effective tax rates included companies listed on the stock exchange over a five-year period (2011 to 2015). During this period, the relative stability of laws, which is essential for a uniform assessment environment, was more prevalent than in the following years. Considering the tax figures presented in the tax returns and those finalized through tax audits, the results of exploratory factor analysis revealed that the highest repetition of factor loadings occurred with long-term accrued and paid taxes. Therefore, by taking into account the finalized tax figures, the difference between the cash effective tax rate (TA_Cash_ETR) had the highest explanatory power, while the difference between accounting profit and taxable income (Perm) had the lowest. When considering the declared tax figures, the two criteria of cash effective tax rate difference (TA_Cash_ETR) and the three-year cash effective tax rate (Cash_ETR3) had the highest, and permanent differences based on discretionary accruals (DTAX) had the lowest explanatory power. In other words, these criteria have the highest and lowest relevance concerning the measurement of tax avoidance in companies operating in Iran’s economic environment. Given that tax regulations in a specific industry may differ from those in another, it is preferable to focus on the criterion with the highest explanatory power and greatest relevance when researching tax avoidance. The clear characteristic of these factors is that considering a multi-year long-term period, while reducing statistical errors, yields more reliable and appropriate results compared to a single fiscal year. Overall, the long-term cash effective tax rate, adjusted by the industry in which the company operates, is a more suitable criterion for measuring and evaluating tax avoidance. On the other hand, although considering finalized company figures is important for measuring the research objective, the declared figures in the tax return are also effective and reliable.