Modeling FinTech Variables on the Profitability of Banks and Financial Institutions Using a Dynamic Systems Approach

Keywords:

FinTech, bank profitability, dynamic systems approachAbstract

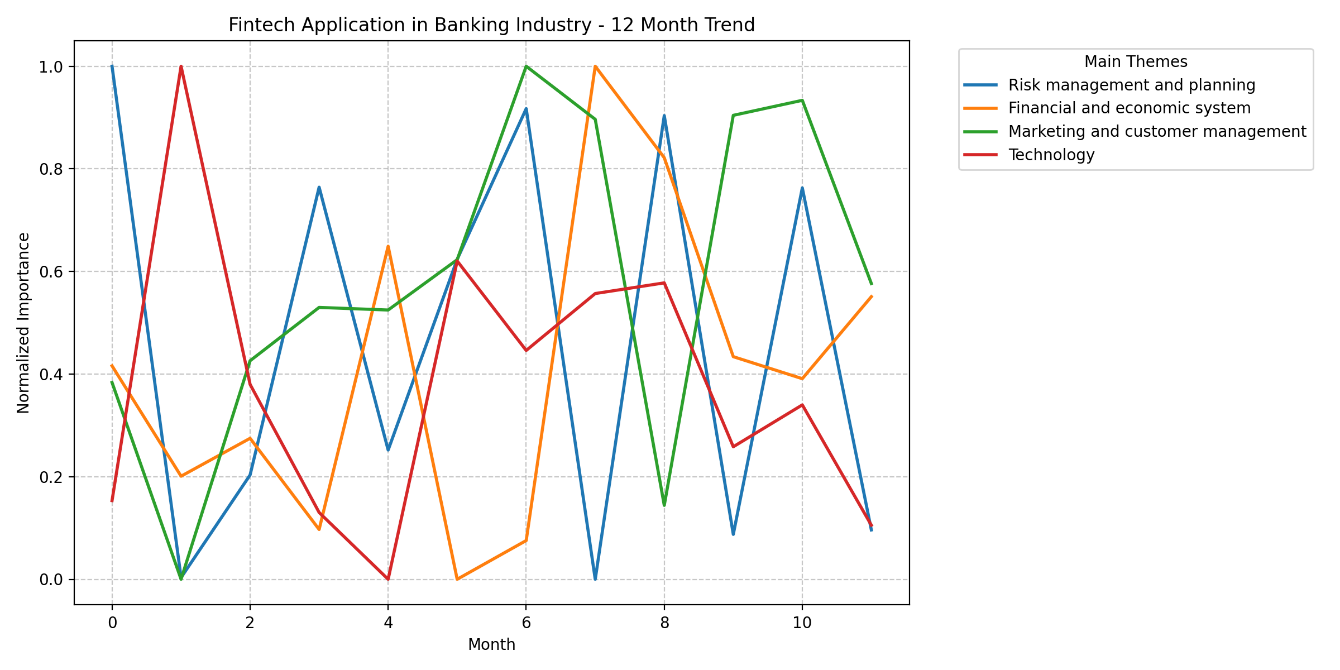

The present study aims to model FinTech variables and their impact on the profitability of banks and financial institutions. FinTech has become a significant factor in reducing financial intermediation, accelerating this process. Consequently, many customers have left commercial banks and turned to FinTech companies. In fact, FinTech has eliminated temporal and spatial limitations. However, these changes have not left banks unaffected, exposing them to various threats. Issues such as resource shortages, delays in collecting receivables, or even their potential loss, external threats, and competition with other banks are factors that may result from outdated banking technologies. This research adopts a dynamic systems approach, which provides a comprehensive dynamic perspective for modeling, combining quantitative and qualitative aspects to simulate a phenomenon over time. The present study is a mixed-method (qualitative and quantitative) research, which is applied in terms of its objective and descriptive-exploratory in terms of data collection method. It is conducted in two qualitative and quantitative sections. The analysis of the positive feedback loop indicates a dynamic process in which risk management and evaluation positively influence each other. Moreover, based on the research findings, FinTech has a positive impact on profitability and efficiency in the banking industry.

References

S. Lv, Y. Du, and Y. Liu, "How Do Fintechs Impact Banks' Profitability?-An Empirical Study Based on Banks in China," FinTech, vol. 1, no. 2, pp. 155-163, 2022, doi: 10.3390/fintech1020012.

S. Y. Abtahi and A. Azadineghad, "Threshold Cointegration of the Stock Market Returns and Currency and Gold Markets in Iran," Financial Engineering and Portfolio Management, vol. 10, no. 38, pp. 1-18, 2019. [Online]. Available: https://sanad.iau.ir/en/Article/1079230.

T. Yao and L. Song, "Examining the Differences in the Impact of Fintech on the Economic Capital of Commercial Banks' Market Risk: Evidence from a Panel System GMM Analysis," Applied Economics, vol. 53, no. 23, pp. 2647-2660, 2021, doi: 10.1080/00036846.2020.1864275.

A. Gupta and N. Arora, "Consumer Adoption of M-Banking: A Behavioral Reasoning Theory Perspective," International Journal of Bank Marketing, vol. 35, pp. 733-747, 2017, doi: 10.1108/IJBM-11-2016-0162.

E. Abad-Segura, M. D. González-Zamar, E. López-Meneses, and E. Vázquez-Cano, "Financial Technology: Review of Trends, Approaches and Management," Mathematics, vol. 8, no. 6, p. 951, 2020, doi: 10.3390/math8060951.

G. Cornelli, J. Frost, L. Gambacorta, P. R. Rau, R. Wardrop, and T. Ziegler, "Fintech and Big Tech Credit: A New Database," 2020. [Online]. Available: https://www.bis.org/publ/work887.pdf.

F. Guo, J. Wang, F. Wang, T. Kong, X. U. N. Zhang, and Z. J. E. Q. Cheng, "Measuring the Development of Digital Inclusive Finance in China: Index Compilation and Spatial Characteristics," China Economic Quarterly, vol. 19, no. 4, pp. 1401-1418, 2020. [Online]. Available: https://www.scirp.org/reference/referencespapers?referenceid=3237116.

G. Kou, X. Chao, Y. Peng, F. E. Alsaadi, and E. Herrera-Viedma, "Machine Learning Methods for Systemic Risk Analysis in Financial Sectors," Technological and Economic Development of Economy, vol. 25, no. 5, pp. 716-742, 2019, doi: 10.3846/tede.2019.8740.

F. Fernando and C. F. Dharmastuti, "Fintech: The Impact of Technological Innovation on the Performance of Banking Companies," in Second Asia Pacific International Conference on Industrial Engineering and Operations Management, Surakarta, Indonesia, 2021, pp. 14-16. [Online]. Available: http://ieomsociety.org/proceedings/2021indonesia/161.pdf. [Online]. Available: http://ieomsociety.org/proceedings/2021indonesia/161.pdf

A. Abbas and R. Shaheen, "Role of Financial Technology in the Banking Sector of Saudi Arabia," PalArch's Journal of Archaeology of Egypt/Egyptology, vol. 18, no. 13, pp. 1190-1198, 2021. [Online]. Available: https://archives.palarch.nl/index.php/jae/article/view/8651.

A. S. Alzwi, J. J. Jaber, H. N. Rohuma, and R. A. Omari, "Evaluation of Total Risk-Weighted Assets in Islamic Banking through Fintech Innovations," Journal of Risk and Financial Management, vol. 17, no. 7, 2024, doi: 10.3390/jrfm17070288.

K. Halteh, R. Alkhouri, S. Ziadat, and F. Haddad, "Fintech Unicorns Forecaster: An AI Approach For Financial Distress Prediction," Migration Letters, vol. 21, no. S4, pp. 942-954, 2024. [Online]. Available: https://migrationletters.com/index.php/ml/article/download/7379/4801/19544.

A. Tarawneh, A. Abdul-Rahman, S. I. Mohd Amin, and M. F. Ghazali, "A Systematic Review of Fintech and Banking Profitability," International Journal of Financial Studies, vol. 12, p. 3, 2024, doi: 10.3390/ijfs12010003.

G. Li, E. Elahi, and L. Zhao, "Fintech, Bank Risk-Taking, and Risk-Warning for Commercial Banks in the Era of Digital Technology," Frontiers in Psychology, vol. 13, p. 934053, 2022, doi: 10.3389/fpsyg.2022.934053.

K. Petralia, T. Philippon, T. N. Rice, and N. Veron, Banking Disrupted?: Financial Intermediation in an Era of Transformational Technology. ICMB International Center for Monetary and Banking Studies, 2019.

J. Haber, I. D'Yakonova, and A. Milchakova, "Estimation of Fintech Market in Ukraine in Terms of Global Development of Financial and Banking Systems," Public and Municipal Finance, vol. 7, no. 2, pp. 14-23, 2018, doi: 10.21511/pmf.07(2).2018.02.

D. Almulla and A. A. Aljughaiman, "Does Financial Technology Matter? Evidence from an Alternative Banking System," Cogent Economics & Finance, vol. 9, no. 1, p. 1934978, 2021, doi: 10.1080/23322039.2021.1934978.