Identifying and Analyzing the Barriers to the Development of Iranian FinTechs in the Financial Industry

Keywords:

financial technology, financial industry, fintech, obstacles, leadership developmentAbstract

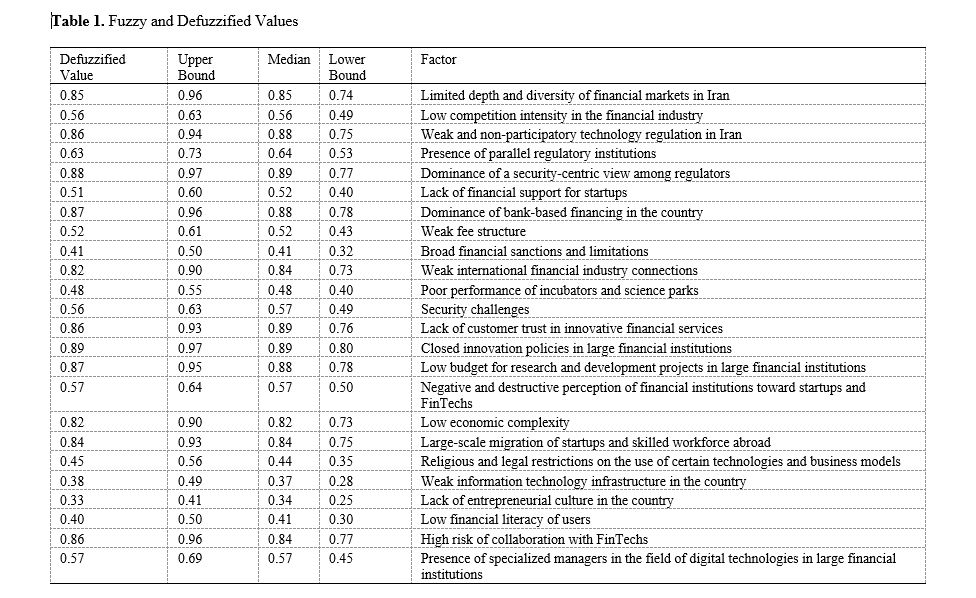

Fintechs play an important role in improving financial industry services by providing new innovations and technologies. However, due to various obstacles, Iranian fintechs have not developed much and have little diversity. Most Iranian fintechs are of the payment type. Considering this challenge, the current research seeks to identify and analyze the most important obstacles to the development of Iranian fintechs in the financial industry. The current research is applied in terms of orientation and has a quantitative methodology. The theoretical population of the research is fintech experts in the country and sampling was done based on expertise in the field of financial technologies with a judgmental method. The sample size in the research was equal to 10 people. At first, 24 fintech development barriers were extracted through literature review and structured interviews with experts. The extracted barriers were screened by distribution of expert questionnaires and fuzzy Delphi method. 11 obstacles had a defuzzy number greater than 0.7 and were selected for final prioritization. The final obstacles were investigated by distributing priority questionnaires and the CoCoSo method. Since the content validity index of all the extracted barriers was higher than 0.79, all the research questionnaires had good validity. Priority obstacles were: low depth and variety of financial markets in Iran, closed innovation policies of large financial institutions, lack of trust of customers in innovative financial services and low budget for research and development projects in large financial institutions.