Presenting a Model of Investors' Emotions and Behavioral Reactions Regarding Stock Portfolio Risk-Taking During the COVID-19 Era

Keywords:

Investor Behavior, Behavioral Finance, Stock Portfolio, Risk TakingAbstract

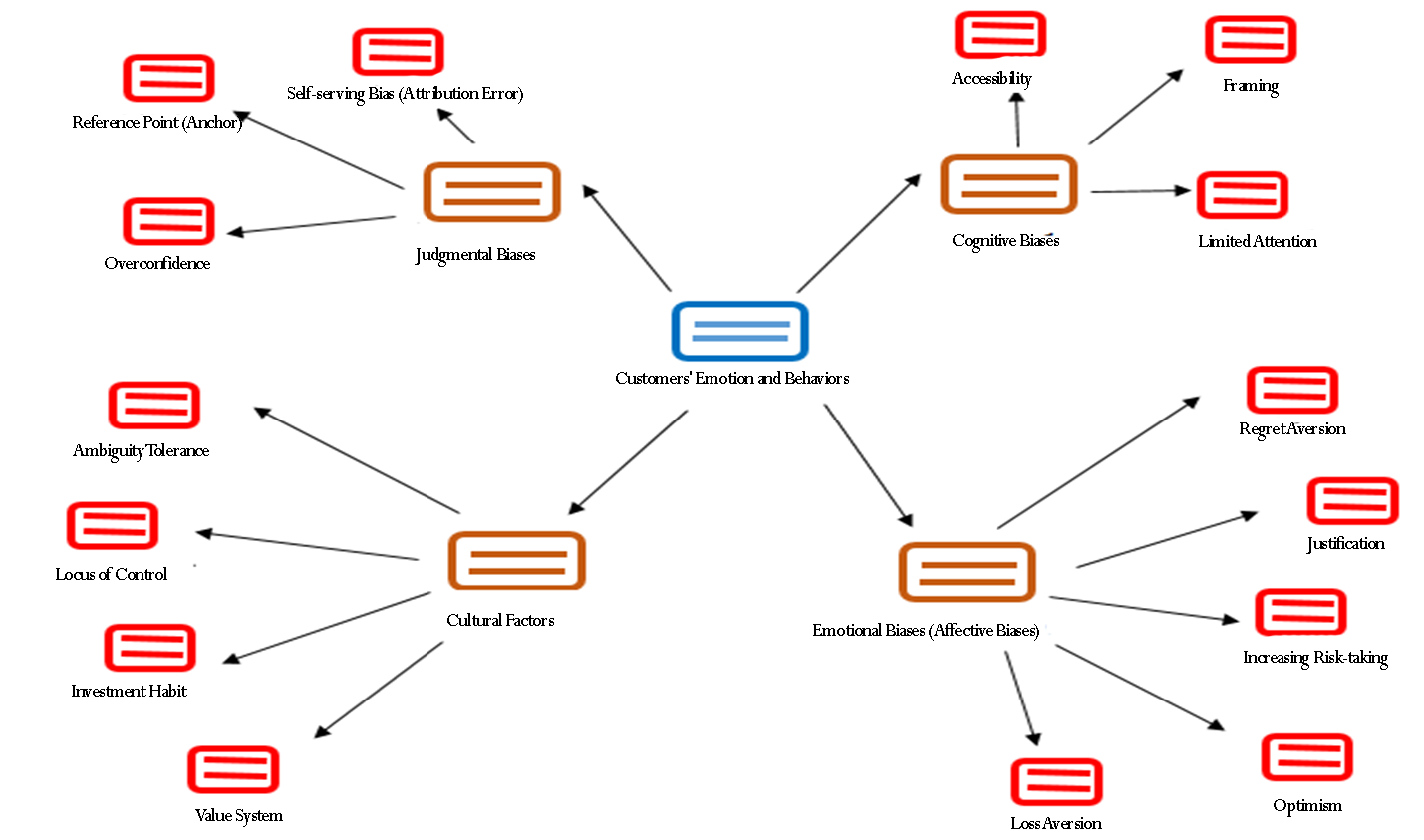

Classical theories are based on the assumption that investors act completely rationally when making decisions, aligning with the theory of the rational economic person. The aim of this study is to present a model of investors' emotions and behavioral reactions concerning stock portfolio risk-taking during the COVID-19 era. The research is an exploratory mixed-method study. The first phase, using an interpretive paradigm and thematic analysis approach, involved interviews with 16 purposefully selected participants until theoretical saturation was achieved. The interview data were analyzed using open coding, and a thematic network of investors' emotions and behavioral reactions concerning stock portfolio risk-taking during the COVID-19 era was developed. Based on the study's findings, the themes were categorized into 46 basic themes, 15 organizing themes, and 4 global themes: cognitive biases (including framing, limited accessibility, and attention), judgmental biases (including self-serving bias, reference point, and overconfidence), emotional (affective) biases (including regret aversion, justification, loss aversion, increasing risk-taking, and optimism), and cultural factors (including locus of control, investment habits, and value system). In the quantitative phase, the research components were quantified using the structural equation modeling technique. According to the results of the quantitative phase, the validity of all four global themes—cognitive biases, judgmental biases, emotional biases, and cultural factors—was confirmed. Moreover, the ranking of the global themes showed that judgmental bias had the highest rank (5.13) in terms of the likelihood of occurrence and influence and exerted the greatest impact on investors' emotions and behavioral reactions regarding stock portfolio risk-taking during the COVID-19 era. Similarly, the other indicators—cognitive biases, cultural factors, and emotional biases—were ranked in subsequent positions.