Developing an Intellectual Capital Model in the Computer Industry Based on Strategies and Outcomes Using the Grounded Theory Method

Keywords:

Strategies, Outcomes, Intellectual Capital, Computer IndustryAbstract

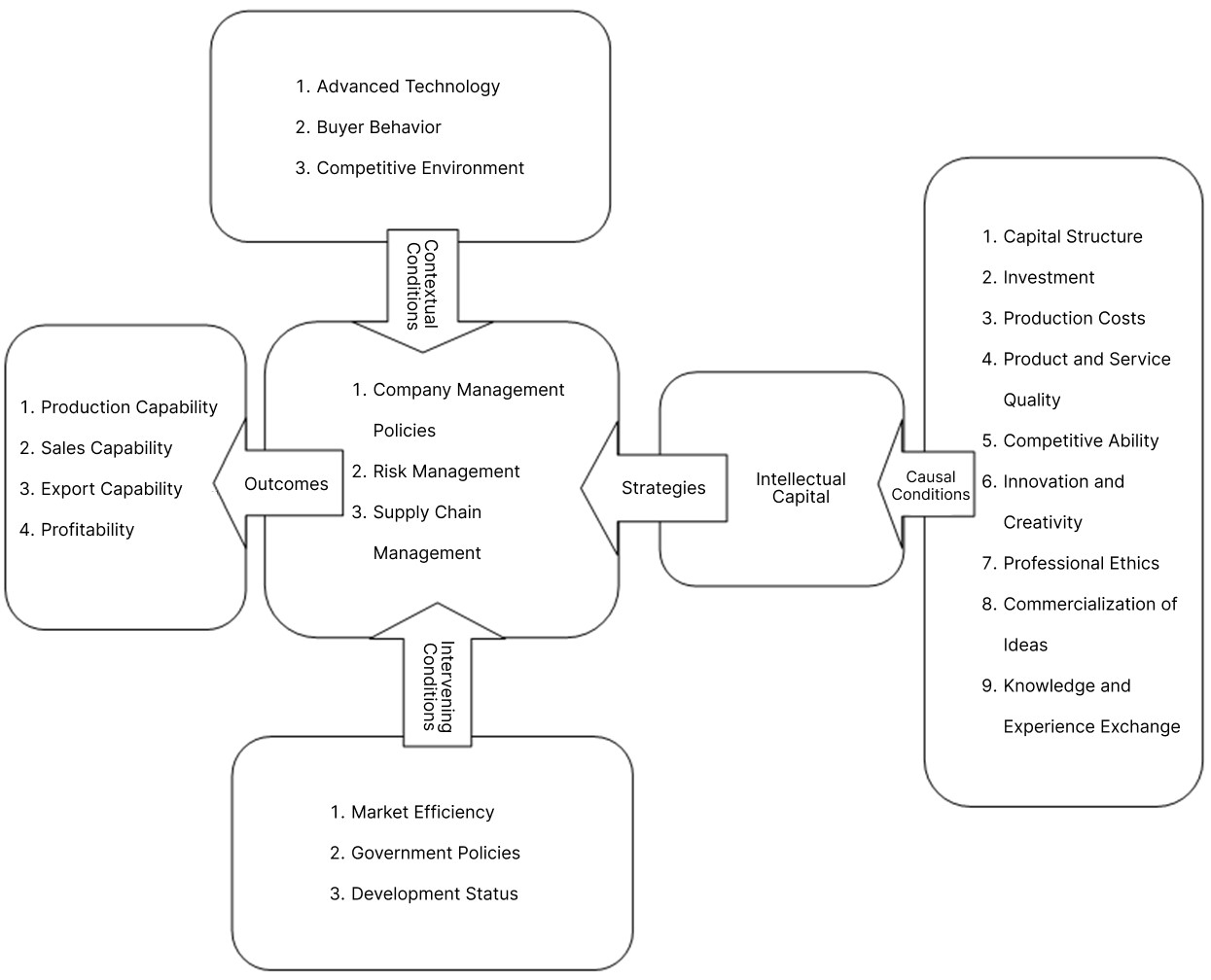

This research aimed to develop an intellectual capital model in the computer industry based on strategies and outcomes using the grounded theory method. The data collection tool was a semi-structured interview conducted with experts. To this end, using a purposive sampling approach (snowball sampling), interviews were conducted with 15 academic experts or senior managers of companies active in the computer industry listed on the Tehran Stock Exchange. The research data were analyzed using the coding method and Strauss and Corbin’s approach, extracting the main categories and concepts. The results indicate that, based on the study’s paradigmatic model, the causal factors of intellectual capital include capital structure, investment, production costs, quality of goods and services, competitive ability, innovation and creativity, professional ethics, commercialization of ideas, and the exchange of knowledge and experience. Contextual factors of intellectual capital include advanced technology, buyer behavior, and the competitive environment. Intervening factors of intellectual capital include market efficiency, general government policies, and the country’s developmental status. Intellectual capital strategies encompass company management policies, risk management, and supply chain management. Moreover, the outcomes of intellectual capital include production capability, sales capability, export capability, and profitability.

References

N. Kanchana and R. R. Mohan, "A review of empirical studies in intellectual capital and firm performance," Indian Journal of Commerce and Management Studies, vol. 8, no. 1, pp. 52-58, 2017, doi: 10.18843/ijcms/v8i1/08.

N. Nuryaman, "The influence of intellectual capital on the firm's value with the financial performance as intervening variable," Procedia-Social and Behavioral Sciences, vol. 211, pp. 292-298, 2015, doi: 10.1016/j.sbspro.2015.11.037.

F. Sardo, Z. Serrasqueiro, and H. Alves, "On the relationship between intellectual capital and financial performance: A panel data analysis on SME hotels," International Journal of Hospitality Management, vol. 75, pp. 67-74, 2018, doi: 10.1016/j.ijhm.2018.03.001.

A. E. Bayraktaroglu, F. Calisir, and M. Baskak, "Intellectual capital and firm performance: an extended VAIC model," Journal of Intellectual Capital, vol. 20, no. 3, pp. 406-425, 2019, doi: 10.1108/JIC-12-2017-0184.

H. K. Singla, "Does VAIC affect the profitability and value of real estate and infrastructure firms in India? A panel data investigation," Journal of Intellectual Capital, vol. 21, no. 3, 2020, doi: 10.1108/JIC-03-2019-0053.

S. Nimtrakoon, "The relationship between intellectual capital, firms' market value and financial performance: Empirical evidence from the ASEAN," Journal of Intellectual Capital, vol. 16, no. 3, pp. 587-618, 2015, doi: 10.1108/JIC-09-2014-0104.

G. Marzo, "A theoretical analysis of the value-added intellectual coefficient (VAIC)," Journal of Management and Governance, vol. 26, no. 2, pp. 551-577, 2022, doi: 10.1007/s10997-021-09565-x.

G. Marzo and S. Bonnini, "Uncovering the non-linear association between VAIC and the market value and financial performance of firms," Measuring Business Excellence, vol. 27, no. 1, pp. 71-88, 2023, doi: 10.1108/MBE-08-2021-0105.

R. V. D. Jordão and V. R. D. Almeida, "Performance measurement, intellectual capital and financial sustainability," Journal of Intellectual Capital, vol. 18, no. 3, pp. 643-666, 2017, doi: 10.1108/JIC-11-2016-0115.

A. Pulic, "Measuring the performance of intellectual potential in knowledge economy," in 2nd McMaster Word Congress on Measuring and Managing Intellectual Capital by the Austrian Team for Intellectual Potential, 1998, pp. 1-20. [Online]. Available: https://www.academia.edu/8959823/Measuring_the_Performance_of_Intellectual_Potential_in_Knowledge_Economy_presented_in_1998_at_the_2nd_McMaster_World_Congress_on_Measuring_and_Managing_Intellectual_Capital_by_the_Austrian_Team_for_Intellectual_Potential.

A. Pulic, "Intellectual capital: Does it create or Destroy Value?," Measuring Business Excellence, vol. 8, no. 1, pp. 62-68, 2004, doi: 10.1108/13683040410524757.

T. Bassetti, L. Dal Maso, G. Liberatore, and F. Mazzi, "A critical validation of the value added intellectual coefficient: use in empirical research and comparison with alternative measures of intellectual capital," Journal of Management and Governance, vol. 24, no. 4, pp. 1115-1145, 2020, doi: 10.1007/s10997-019-09494-w.

B. T. T. Truong and P. Nguyen, "Driving business performance through intellectual capital, absorptive capacity, and innovation: The mediating influence of environmental compliance and innovation," Asia Pacific Management Review, vol. 29, no. 1, pp. 64-75, 2024, doi: 10.1016/j.apmrv.2023.06.004.

A. H. Ozgun, M. Tarim, D. Delen, and S. Zaim, "Social capital and organizational performance: The mediating role of innovation activities and intellectual capital," Healthcare Analytics, vol. 2, pp. 1-12, 2022, doi: 10.1016/j.health.2022.100046.

H. Malazadeh Jabdarghi, M. Zeinali, A. A. Nunehal Nahr, and A. Mohammadi, "Explaining the variables affecting the measurement of intellectual capital and proposing an optimal model," Quarterly Journal of Value Creation in Business Management, vol. 4, no. 3, pp. 141-161, 2024. [Online]. Available: https://www.jvcbm.ir/article_196096.html.

V. Kefili, M. Mirzaei Nezamabad, and H. Hosseinlou, "Intellectual capital and its impact on the financial performance of pharmaceutical companies," Development and Capital Journal, vol. 7, no. 2, pp. 157-172, 2022. [Online]. Available: http://ensani.ir/fa/article/518923/%D8%B3%D8%B1%D9%85%D8%A7%DB%8C%D9%87-%D9%81%DA%A9%D8%B1%DB%8C-%D9%88-%D8%AA%D8%A3%D8%AB%DB%8C%D8%B1-%D8%A2%D9%86-%D8%A8%D8%B1-%D8%B9%D9%85%D9%84%DA%A9%D8%B1%D8%AF-%D9%85%D8%A7%D9%84%DB%8C-%D8%B4%D8%B1%DA%A9%D8%AA-%D9%87%D8%A7%DB%8C-%D8%AF%D8%A7%D8%B1%D9%88%D8%A6%DB%8C.

M. Eshghi and H. Eshghi, "Examining the impact of intellectual capital components on financial performance," New Research Approaches in Management and Accounting, vol. 5, no. 50, pp. 33-47, 2020. [Online]. Available: https://www.joas.ir/user/articles/3893.