Examining and Comparing the Efficiency of MLP and SimpleRNN Algorithms in Cryptocurrency Price Prediction

Keywords:

MLP algorithm, SimpleRNN algorithm, cryptocurrency priceAbstract

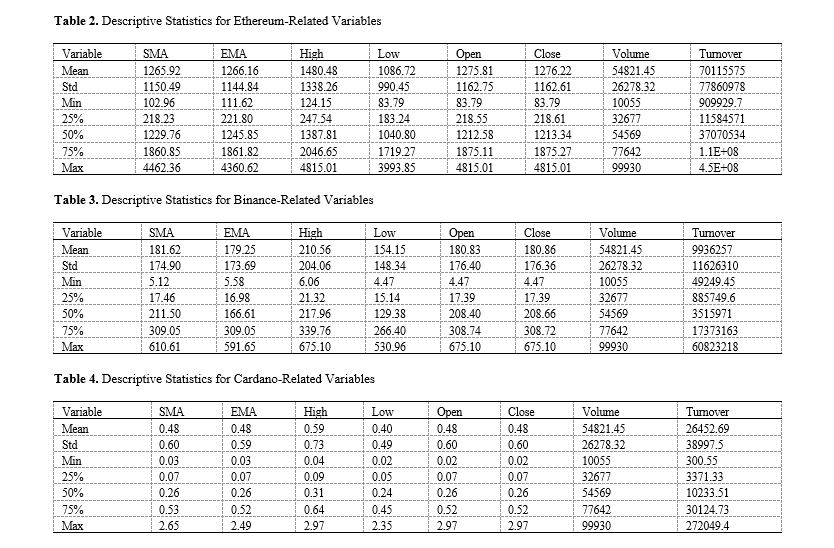

Cryptocurrencies have been widely identified and established as a new form of electronic currency exchange, carrying significant implications for emerging economies and the global economy. This research focused on the "examination and comparison of the efficiency of MLP and SimpleRNN algorithms in predicting cryptocurrency prices" using the Python programming language. Price predictions for Bitcoin, Ethereum, Binance Coin, Cardano, and Ripple were made using two deep learning algorithms (including the MLP algorithm and the SimpleRNN algorithm) over the period from 2017 to 2023. The results of cryptocurrency price prediction using deep learning algorithms were satisfactory; and the comparison of predictions across all cryptocurrencies indicated minimal differences between the algorithms studied, suggesting that they were efficient and had low error rates. Based on the obtained results regarding Bitcoin price prediction, the best algorithm was SimpleRNN; for Ethereum price prediction, the best algorithm was MLP; for Binance Coin price prediction, the best algorithm was SimpleRNN; for Cardano price prediction, the best algorithm was MLP; and for Ripple price prediction, the best algorithm was MLP.

References

E. Pintelas, I. E. Livieris, S. Stavroyiannis, T. Kotsilieris, and P. Pintelas, "Investigating the Problem of Cryptocurrency Price Prediction: A Deep Learning Approach," in AIAI 2020: Artificial Intelligence Applications and Innovations, 2020, pp. 99-110.

A. Webb, "Decentralized Finance (DeFi) and Its Implications on Traditional Network Economics: A Comparative Study on Market Power, Pricing Dynamics, and User Adoption," International Journal of Cryptocurrency Research, vol. 4, no. 1, pp. 40-46, 2024, doi: 10.51483/ijccr.4.1.2024.40-46.

B. Y. Almansour, S. Elkrghli, and A. Y. Almansour, "Unravelling the Complexities of Cryptocurrency Investment Decisions: A Behavioral Finance Perspective From Gulf Investors," International Journal of Professional Business Review, vol. 8, no. 7, p. e03265, 2023, doi: 10.26668/businessreview/2023.v8i7.3265.

W. Romadhon and S. Andriani, "The Effect of Tax Policies, Money Laundering Practices, and Tax Avoidance on Crypto Asset Transactions in Indonesia," Jurnal Ilmiah Manajemen Ekonomi & Akuntansi (Mea), vol. 7, no. 1, pp. 202-215, 2023, doi: 10.31955/mea.v7i1.2865.

J. Tayazime and A. Moutahaddib, "DeFi, Blockchain and Cryptocurrencies: Proposing a Global Money Matrix for the Blockchain Era," European Scientific Journal Esj, vol. 19, no. 16, p. 160, 2023, doi: 10.19044/esj.2023.v19n16p160.

L. Zhang and H. Wen, "A Study of Financial Engineering Security Issues Based on Block Cryptography," pp. 707-717, 2023, doi: 10.2991/978-94-6463-200-2_73.

S. Shukla and S. Dave, "Bitcoin beats coronavirus blues," ed, 2020.

J. Kaur, S. Kumar, B. E. Narkhede, M. Dabić, A. P. S. Rathore, and R. Joshi, "Barriers to blockchain adoption for supply chain finance: the case of Indian SMEs," Electronic Commerce Research, vol. 24, no. 1, pp. 303-340, 2024, doi: 10.1007/s10660-022-09566-4.

M. Kalkan, "BERE: Ensuring Immutability and Transparency With Blockchain in Real Estate Appraisal Industry," 2024, doi: 10.21203/rs.3.rs-4541995/v1.

I. E. Livieris, S. Stavroyiannis, E. Pintelas, and P. Pintelas, "A novel validation framework to enhance deep learning models in time-series forecasting," Neural Computing and Applications, vol. 32, pp. 17149-17167, 2020, doi: 10.1007/s00521-020-05169-y.

E. Akyildirim, O. Cepni, S. Corbet, and G. S. Uddin, "Forecasting mid-price movement of Bitcoin futures using machine learning," Annals of Operations Research, 2021, doi: 10.1007/s10479-021-04205-x.

M. Iqbal, M. S. Iqbal, F. H. Jaskani, K. Iqbal, and A. Hassan, "Time-Series Prediction of Cryptocurrency Market using Machine Learning Techniques," EAI Endorsed Transactions on Creative Technologies, 2021, doi: 10.4108/eai.7-7-2021.170286.

Z. Ftiti, W. Louhichi, and H. B. Ameur, "Cryptocurrency volatility forecasting: What can we learn from the first wave of the COVID‑19 outbreak," Annals of Operations Research, 2021, doi: 10.1007/s10479-021-04116-x.

T. E. Koker and D. Koutmos, "Cryptocurrency Trading Using Machine Learning," Journal of Risk and Financial Management, vol. 13, no. 8, 2020, doi: 10.3390/jrfm13080178.